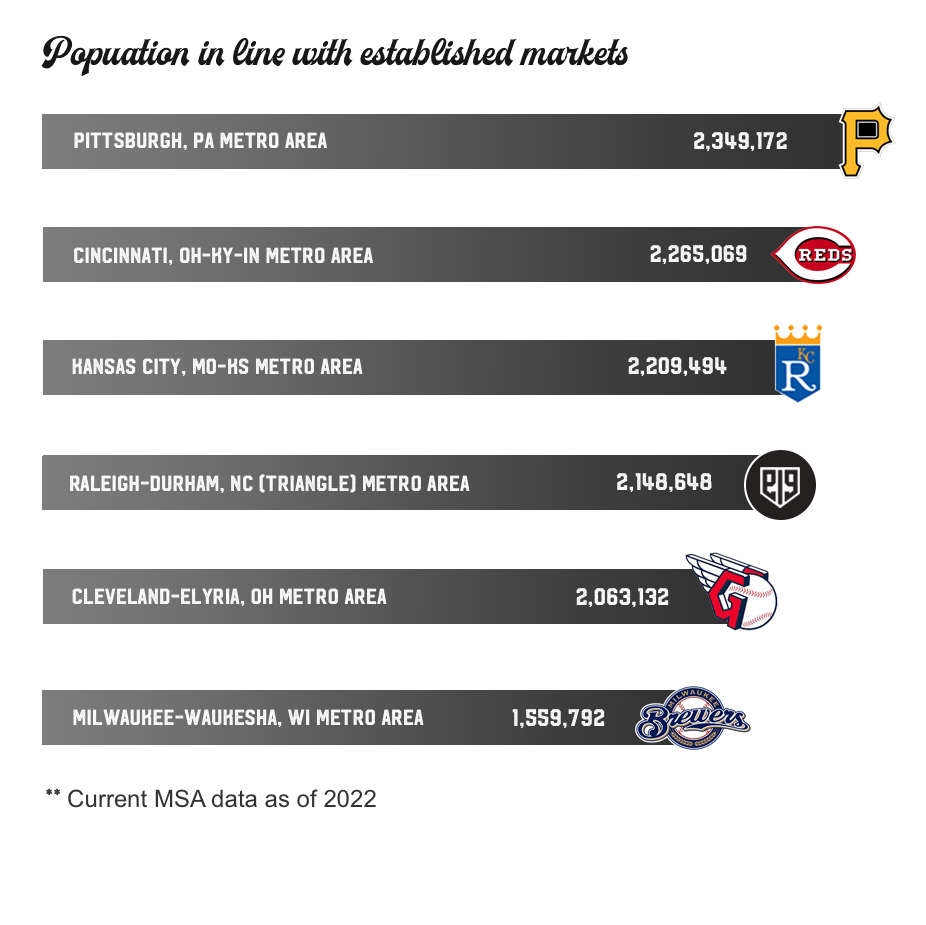

The Triangle's population is in line with established MLB markets and growing faster

Did you know that the Triangle’s population is in line with MLB markets such as Milwaukee, Kansas City, Cincinnati, Cleveland and Pittsburgh (all of which have MLB teams)?

If you didn’t, you’re not alone.

Measuring the Triangle’s population in comparison with other metro areas that support MLB teams sounds like it’d be an easy task. However, thanks arbitrary definitions that don’t take into consideration the unique setup of the Triangle, it’s actually quite complicated.

Prior to 2000, the area’s growth and population were being measured using what was called the Raleigh-Durham MSA. The MSA (Metropolitan Statistical Area) is a common data point that cities use to measure population and density within a region’s commuter belt.

Because of the Triangle’s unique layout where 3 key population centers fall within one commuter belt (and are less than 25 miles apart), a combined MSA made sense.

It gave a true snapshot of the population radius of the area and gave a good idea of the area’s ability to support things that would draw from the surrounding area (like professional sports).

In 2000, the census split Raleigh and Durham’s MSA thanks to adjustments made to the definition of a ‘Metro Statistical Area’. They took into consideration the percentage of commuters who commute into the city, however, we have a central area called Research Triangle Park in the middle of both Durham and Raleigh where most of our workforce commutes. The county line goes right through the middle of RTP, and thus, you can see how arbitrary that ‘commuter percentage’ ends up being.

This change created a situation where you now had the census reporting the Triangle area as two smaller cities. This dropped the region off of many lists and rankings that had them approaching major metro status. To this day, the census discrepancy continues to exist.

So how do you get a true idea of how the Triangle would rank against other regions in total population?

Well, the official Raleigh MSA isn’t going to be accurate anymore for us. However, we can get a much better apples-to-apples comparison by recombining the former Raleigh-Durham MSA. We do this by simply taking the Raleigh MSA and adding it to the Durham MSA.

According to the latest numbers, that Raleigh-Durham MSA has a total population of 2,148,648 (covering nearly 5,000 square miles).

When we put our market up against existing markets, what we found was what we expected. The Triangle’s density is on par with a number of established MLB markets and growing faster than all of them.

The Triangle’s population of 2,148,648 comes in ahead of Cleveland’s metro area population of 2,063,132 and the Milwaukee-Racine-Waukesha, WI metro area which has a population of 1,559,792.

**Note that Milwaukee led the MLB in games attended per capita and finished 14th overall in attendance in 2022.

The Triangle is also hot on the heels of Kansas City, whose MSA comes in at 2,209,494, Cincinnati, whose area CSA population is at 2,241,626 (covering 4,814.5 sq. miles) and Pittsburgh’s metro area whose population is at 2,349,172 and declining (covering 5,281 sq. miles).

If that isn’t enough, only one other metro area (Austin, TX) grew faster (net population growth %) than the Raleigh metro area from 2016 to 2021.

And this is where it all gets really interesting.

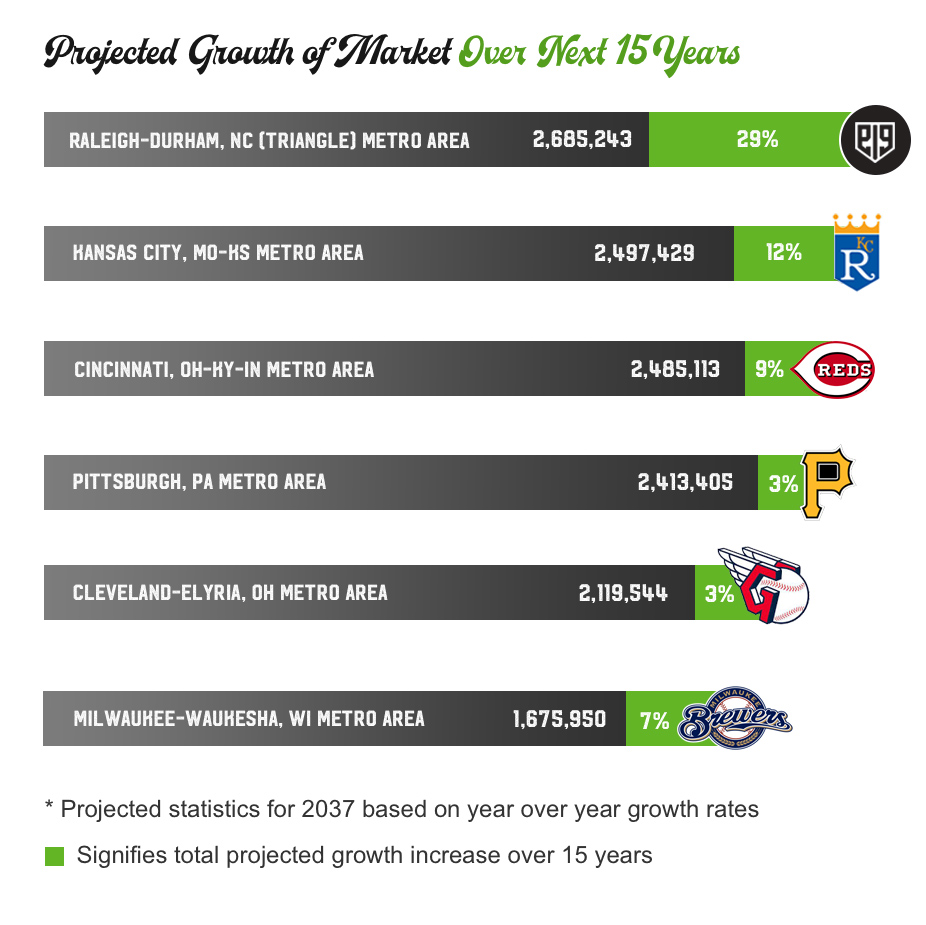

Growth Rates show the Triangle market eclipsing all Small-Market Baseball in 15 years

See, MLB isn’t investing for today. They will be investing in a region for the foreseeable future, meaning growth forecasts really matter, and this is where the Triangle shines.

We took official population numbers and added in the projected growth rates for each market over the next 15 years and what we found explains exactly why Raleigh is the right fit for Major League Baseball.

By 2037, adding in forecasted growth rates, the Triangle finds itself well above ALL of small-market baseball. Above, Kansas City, Cincinnati, Pittsburgh, Cleveland, and Milwaukee. In fact, we’d be right on the cusp of mid-market cities like St. Louis.

The point is, a Raleigh-anchored team in this region is already feasible based on the current population/density numbers and we just so happen to be growing faster than any other MLB market.

**All statistics based on Census.gov’s latest ACS (American Community Survey) numbers and population/growth data from the NC Dept of Commerce.

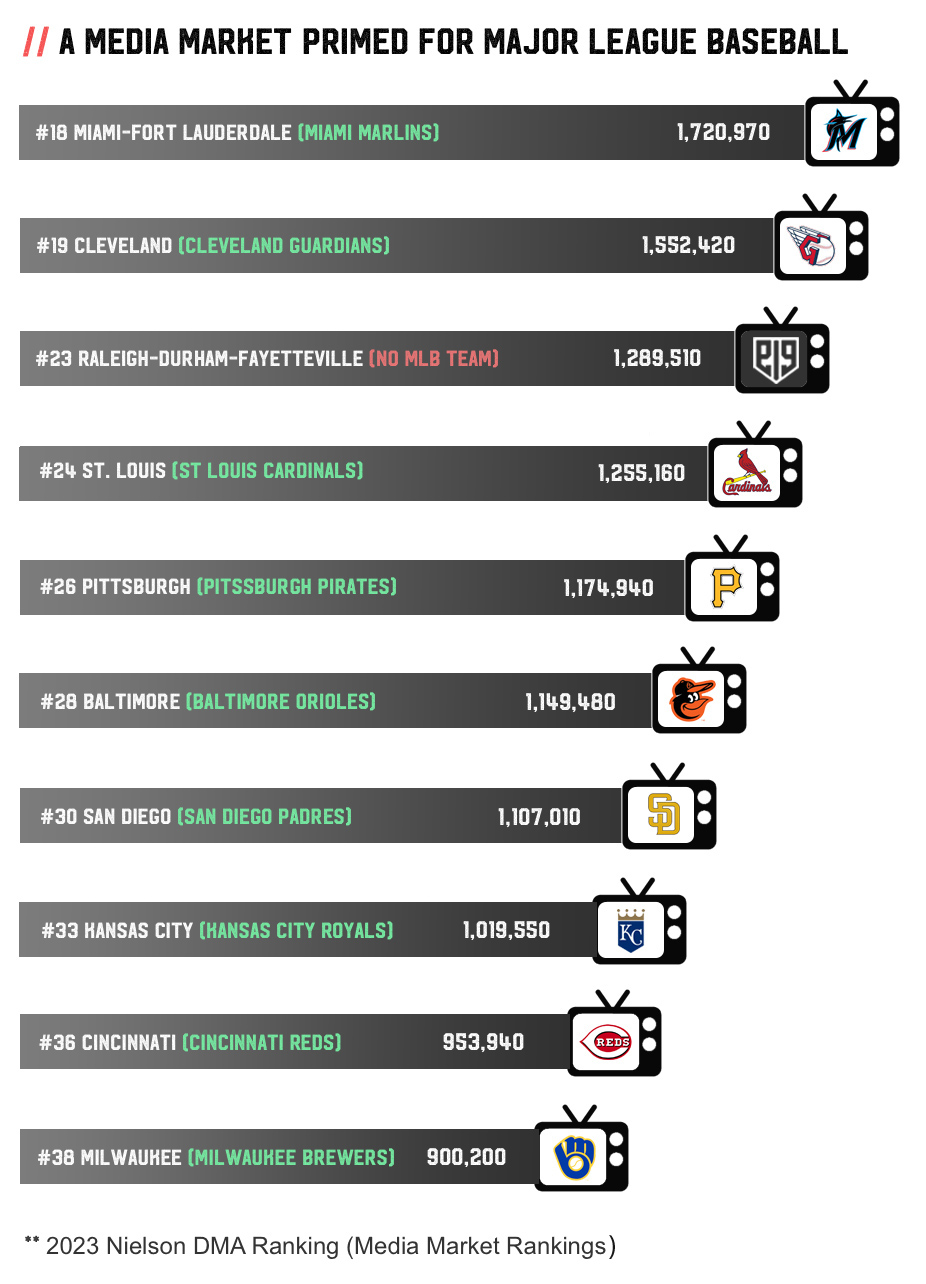

The Raleigh/Durham TV market is the #1 largest in the nation without a locally or regionally broadcasted MLB team, ranking 23rd overall

One of the primary reasons that MLB commissioner Rob Manfred will be looking at North Carolina when it’s time to expand is the fact that the closest teams are The Washington Nationals to the North, and Atlanta Braves to South.

Actually, it isn’t just distance that is keeping Triangle residents from watching baseball. It’s also the fact that they don’t have a local MLB broadcast, (both the Orioles and Nationals are blacked out here due to territory disagreements with cable providers and the Braves coverage doesn’t extend this far east).

Statistically, Raleigh/Durham has the largest TV market in the USA without a locally or regionally broadcasted MLB team. While there are three cities ahead in these rankings that do not have MLB teams in their city, they are all close enough to teams that they are included in the regional broadcasts..

If you’re wondering if Raleigh’s TV market could support an MLB team based on size, it can. As it stands currently, Raleigh/Durham’s TV market is already larger than the markets of St. Louis, Pittsburgh, Baltimore, San Diego, Kansas City, Milwaukee, and Cincinnati, all of which are markets that support MLB teams.

Our region also has stronger media markets than many other expansion hopefuls such as Nashville (#27), Salt Lake City (#29), San Antonio (#31) and Las Vegas (#40). Meanwhile, we are .003% away from passing Portland (#22) and .027% away from passing Charlotte (#21).

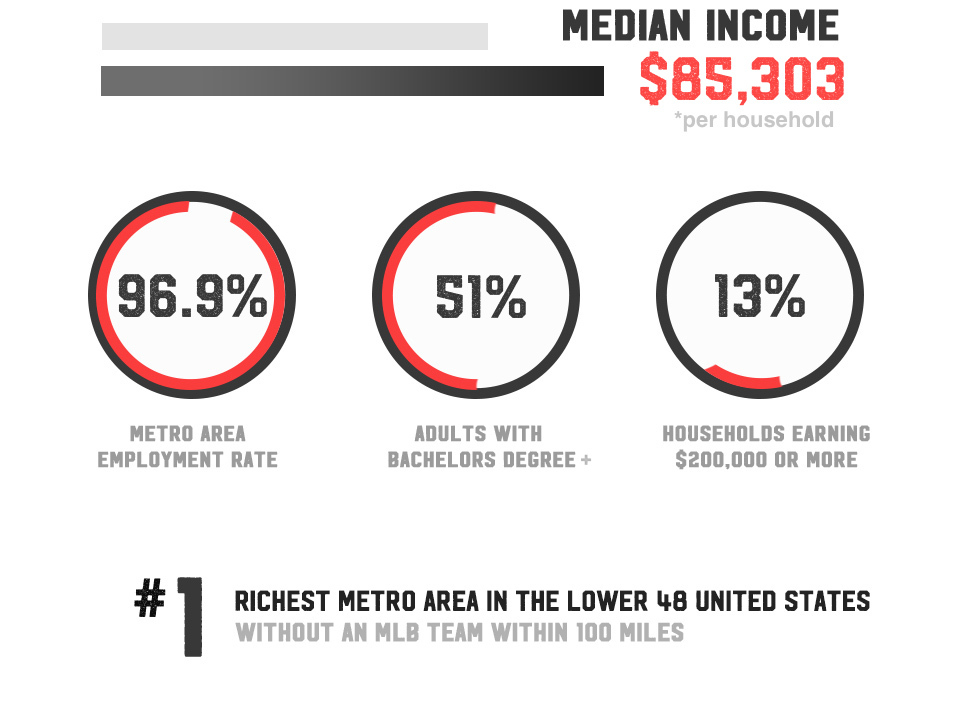

Raleigh is the #1 richest metro area in the continental United States without an MLB team within 100 miles

The Raleigh metro area has a median household income of $85,303 with 13% of households making over $200,000. The area also boasts an outstanding rate of adults with at least a bachelor’s degree, coming in at 51%.

These number may not be surprising when you consider the fact that some of the nation’s most prestigious universities (Duke, UNC, and NC State) are located within 30 miles of Raleigh.

These factors have Raleigh ranked as the 19th wealthiest metro area in the United States, and when you map those out based on median household income of cities with populations above 20k, it’s the richest in the lower 48 states that does not have an MLB team within 100 miles.

Why is this statistic important?

Well, MLB viability is based on population, TV market, corporate sponsorship opportunities, and how much money an area’s residents bring in. This stat shows you that people in the Triangle not only have a lot of disposable income but that Major League Baseball currently doesn’t have a way to tap into that. A Raleigh-based team would certainly change that.

An MLB team would have very little regular season overlap with other major sports teams in the Triangle

With a Top-25 TV market, Raleigh-Durham is in a unique spot when it comes to sports. They have some of the best college basketball in the country, and North Carolinians love their football, but in Raleigh, the only competing pro sports team would be the Carolina Hurricanes.

ACC college basketball goes from November to March. ACC college football regular season goes from the last day of August to December, with meaningful games not usually getting started until mid-September. Then there is hockey. The NHL regular season goes from October to early April.

Baseball season starts in early April and goes through October. This would mean baseball regular season would really only overlap with College football in September and overlap with the hockey regular season for a few days in April.

**There would be about another total month overlap if teams were to make post-season

It’s rare that a metro with a Top-25 TV market and a population base this large would have a 6-month major sports gap from April to September. This would bode well for TV ratings and ticket sales, keeping fan’s attention and financials-focused on the baseball team for a majority of the summer.

MLB in Raleigh would generate more tax revenue for the city than any other pro-sport (and it's not even close)

Population numbers, TV market size, and area income stats are all important when you’re talking about viability for professional sports in a city. But that is just one side of the coin.

The other thing that needs to be weighed is whether or not a new stadium and a professional franchise are financial ‘net-positives’ for the city.

Baseball nay-sayers like to mention the fact that attendance for the sport was down a few percentages the last season. They like to talk about how football is the new ‘America’s pastime’ or how soccer is the fastest growing sports in the country.

Sure, Football is doing fine and soccer is growing, but those comments hold a lot less water when you put everything in context. In fact, no major sport in America brings more fans per season to the stadium than Major League Baseball (and it’s not even close).

You’ll see that NFL is far and away averaging the most fans per game, but look who comes in 2nd on that list. It’s Major League Baseball at over 28k per game. Then there’s almost a 7,000 fan per game buffer before you get to MLS, who is respectably filling up the stands as well.

The per-game attendance numbers are popular and easy to find in the media. MLS uses this number a lot to show that their sport is gaining popularity. NFL uses these numbers to try to prove utter dominance in the American sports landscape. However, this stat doesn’t tell you the full story.

To understand just how popular a sport is and how much of an impact a franchise would have on a city, you have to pair it with the number of home games that team would play per-season.

What you find is that MLB far and away has the most home games with 81. NBA and NHL are next with 41 a piece, then there is MLS with only 17 and NFL with a measily 8.

What should jump out at you here is that two of the top-3 sports in per-game attendance are in the cellar (MLS & NFL) when it comes to ‘number of home games.’ Meanwhile, MLB sits at the top with 81, leading every other sport by a massive margin.

It means that MLB sustains higher attendance numbers for much longer than any other sport. In fact, when projected out to a full season, an MLB team, on average, accounts for 2,332,314 fans at home games per-season. After that NBA and NHL drop to just over 700k, NFL comes in at 547,200 and MLS check in with only 371,841 fans at home games per-season.

These numbers are staggering from a city’s perspective. For them, a professional franchise and a new stadium is an investment. The payoff is the increase in tourism and the generation of tax dollars. These stats show you that MLB is, by far, the golden goose of pro sports for a city.

2,332,314 people paying for tickets, a good portion of them staying in hotels (thanks to baseballs 3-game series set-up), eating dinner and getting drinks downtown. All of these things would be bringing in tax revenue that our city currently is missing out on.

If Raleigh wants bang for its buck from a professional sports franchise, then they need to be all in on Major League Baseball in this coming round of expansion and relocation

North Carolina is the #1 state for business, has the top rated business climate, and boasts the lowest corporate tax rate in the U.S.

The Triangle doesn’t just have massive population growth, a primed media market, and high individual wealth, it also has a strong and budding corporate climate.

Before we dive into the Triangle’s recent corporate boom, let’s talk about North Carolina as a whole.

North Carolina was ranked the #1 state for business by CNBC last year. They were also named the #1 best business climate in America, and took home the gold (#1) in the all-encompassing Site Selection Prosperity Cup in 2022, which factors in a host of variables, including the total new/expanded facilities, total capital investment in new facilities, total new jobs created, corporate real estate rank and state tax climate.

Speaking of the tax climate, there’s no better state to do business in than the Tarheel state. North Carolina has THE LOWEST corporate income tax rate in the country, coming in at 2.5%. The closest states to us in that category is Missouri and Oklahoma, both of which have 4% corporate income tax rates. But the state isn’t resting on its laurels with that number. In fact, the general assembly recently passed a law that tapers this number down, all the way to zero. You read that right, by 2030 North Carolina will be the only state in America to offer companies ZERO corporate income tax. So open up the floodgates folks, because companies will be heavily incentivized to bring their jobs to North Carolina over the next few years.

North Carolina’s strong foundation of incentives to bring corporations to the state means more sponsorship deals, more partnerships, and more boxes filled for a potential MLB team. But when it comes down to location, Charlotte has been the pick for major banking companies and corporate headquarters in the past. Howver, things are changing.

Today, the Triangle has become a hotbed for tech, innovation, biotech, and clean energy jobs. These are some of the fastest-growing job sectors in the country.

Over the past 5 years, Wake and Durham county added 10,000+ new jobs with a $121,000 average wage. Overall the region added $5.5 billion in private investment, none bigger than the Apple east coast headquarters which will begin construction shortly.

While Apple might be the biggest name, they join a host of companies who moving in or expanding in the Triangle including Wolfspeed, Fujifilm, Novartis, Lilly, Iqvia (Fortune 500), and more. Those new names join a host of companies with big-time presence currently here such as Advanced Auto Parts and Martin Marietta Materials, along with the big names with satellite offices here, including Google, MetLife, LapCorp, and IBM to name a few.

The old thought was that Raleigh’s lack of Fortune 500 companies would hinder it in terms of suite sales, but according to top MLB consultants, the league is moving away from suite-heavy stadium builds in favor of unique large-group seating options. This caters to smaller markets with more emerging mid-tier companies (such as Raleigh), and doesn’t rely as heavily on a market being filled with Fortune 500 headquarters.

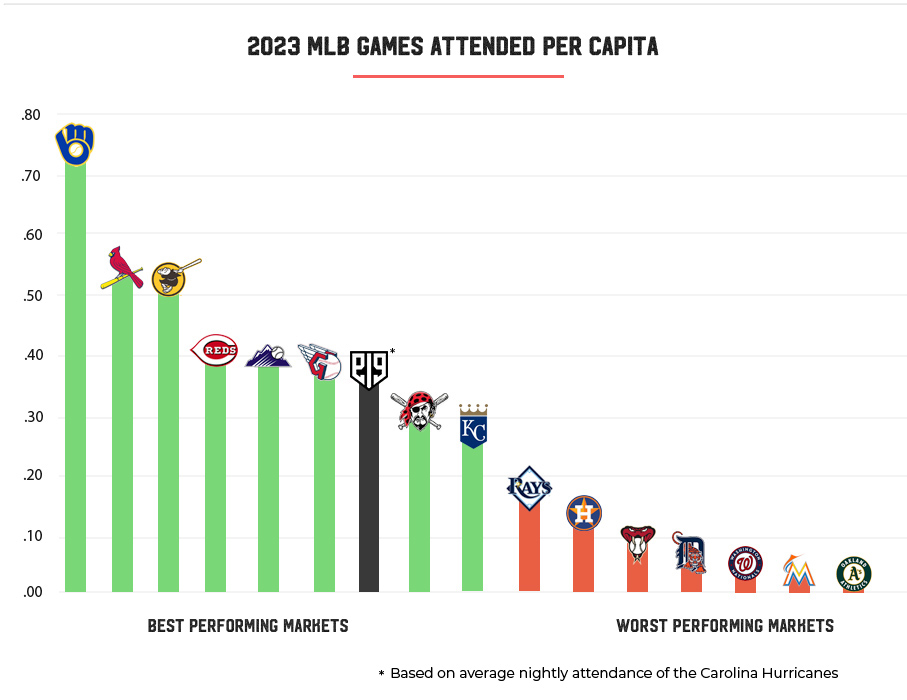

A Raleigh-based team with average small-market attendance would rank as one of the best performing markets in 'per capita attendance'

There is no denying that Raleigh would be considered a small market team (at least for the first 10-years). However, data suggests that it is actually a good thing when it comes to viability and sustainability.

The teams playing in the 7 TV markets smaller than Raleigh/Durham all find themselves in the Top 10 in ‘MLB games attended per capita.’ This means that while they might be smaller markets with lower populations, their fans are filling up their stadiums and spending money on their teams.

So what does this mean?

It means you don’t need a massive population to have a successful franchise in Major League Baseball.

It shows that smaller market teams are actually getting great support from their communities. For example, as we pointed out, the Milwaukee Brewers don’t rank higher than the Triangle’s population numbers, yet they get the best per-capita attendance in Major League Baseball and finished 10th in overall attendance in 2021. For context, the Brewers our outpacing Washington, Seattle, Texas, Arizona, Baltimore, and Miami (to name a few) in attendance despite being from a much, much smaller market.

In fact, if Raleigh were to get a team, and averaged the same nightly attendance numbers as the Carolina Hurricanes (19,526), they would find themselves ranked #7 in MLB in ‘per capita attendance.’

Now, note that the five smallest markets in MLB average 21,236 fans per game. If a Raleigh team were to simply meet that average nightly, they would be #6 in MLB in ‘per capita attendance.”

In both scenarios, a Raleigh-based team would find itself as one of the “Best Performing Markets” in per capita attendance.

*Per Capita Attendance = Total Attendance ÷ Regional MSA

** Stats via ESPN , June 2023